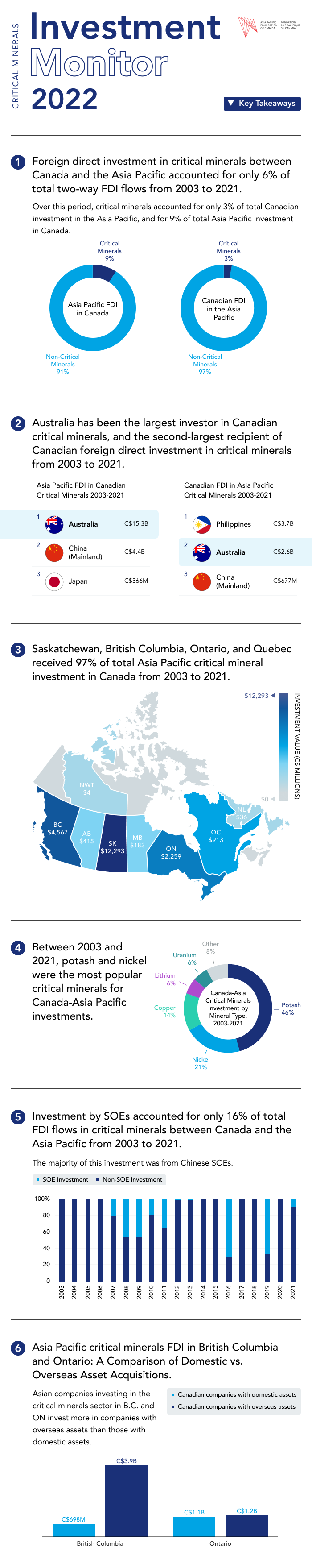

Executive Summary

Critical minerals are essential inputs for advanced technologies required for sustainable development and clean energy transition. The global drive to achieve net-zero targets accelerates global demand for critical minerals and shapes corporate strategies, including foreign direct investment (FDI) decisions. This Investment Monitor report offers a timely overview of critical minerals investment between Canada and the Asia Pacific, providing policymakers, companies, and governments with a comprehensive understanding of major national, provincial, and sectoral investment trends.

The Investment Monitor report also outlines Canada’s provincial programs and incentives to support the development of critical mineral industries. More incentives have been announced in the federal government’s 2021 and 2022 budgets, as summarized in The Canadian Critical Minerals Strategy, which was released in December 2022. Together, these incentives will likely influence the two-way investment flow between Canada and Asia in the upcoming years as they will encourage critical mineral exploration in Canada.

This Investment Monitor report, our third and final of 2022, focuses on two-way, Canada-Asia FDI flows in critical minerals and identifies and contextualizes key investment trends over the past 19 years. In doing so, the report details the evolution of Canada-Asia Pacific critical minerals investment by providing the following:

- Detailed analysis of inward and outward critical minerals investments between Canada and the Asia Pacific at the national and sub-national levels from 2003 to 2021

- Review of foreign investment by mineral type to identify which minerals are in the highest demand

- National and sub-national policies that encourage or dissuade FDI in the critical minerals sector

- The attractiveness of the critical minerals sector for Canadian and Asia Pacific state-owned enterprises (SOEs)

Infographic